IRS Form 2290 is a crucial document for those involved in the transportation industry within the United States. This statement is specifically designed for owners of heavy highway vehicles, such as trucks, trailers, and buses, who must pay an annual federal highway use tax. By completing and submitting a 2290 tax form PDF, the owners demonstrate compliance with taxation regulations and contribute to the maintenance and development of the nation's highways.

Navigating tax forms can be a complex task, but 2290-form-printable.com can be an invaluable resource in this process. We provide a comprehensive guide to IRS Form 2290 instructions, making it easier to understand the requirements and accurately complete the template. Furthermore, our website offers printable tax form 2290 and easy-to-follow examples that can significantly reduce the likelihood of errors. By utilizing the materials available on 2290-form-printable.com, filers can efficiently print the 2290 tax form and confidently submit it to the IRS, ensuring they meet their legal obligations and contribute to the improvement of the country's transportation infrastructure.

IRS Form 2290: Taxpayers Obligated to File HVUT

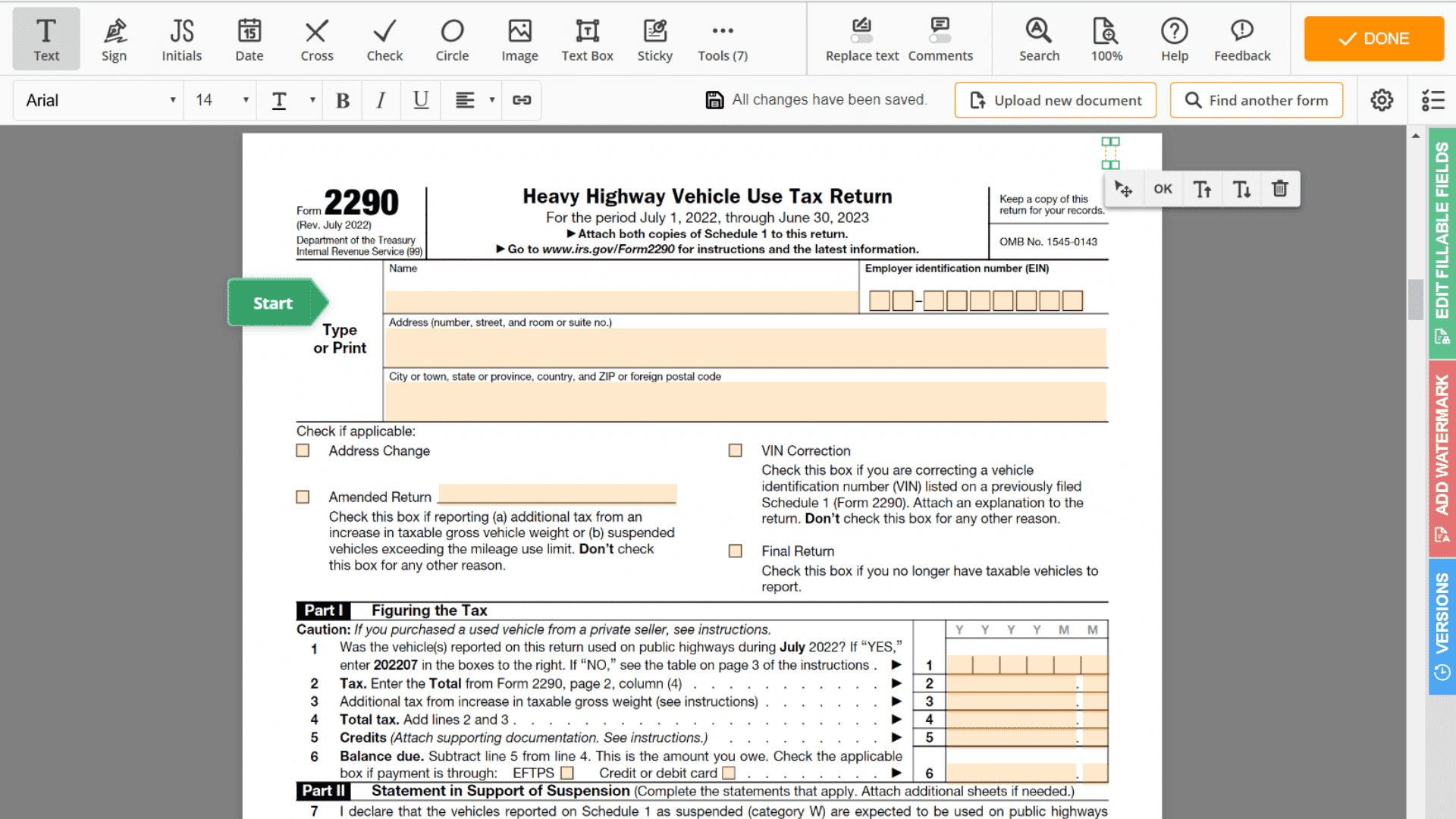

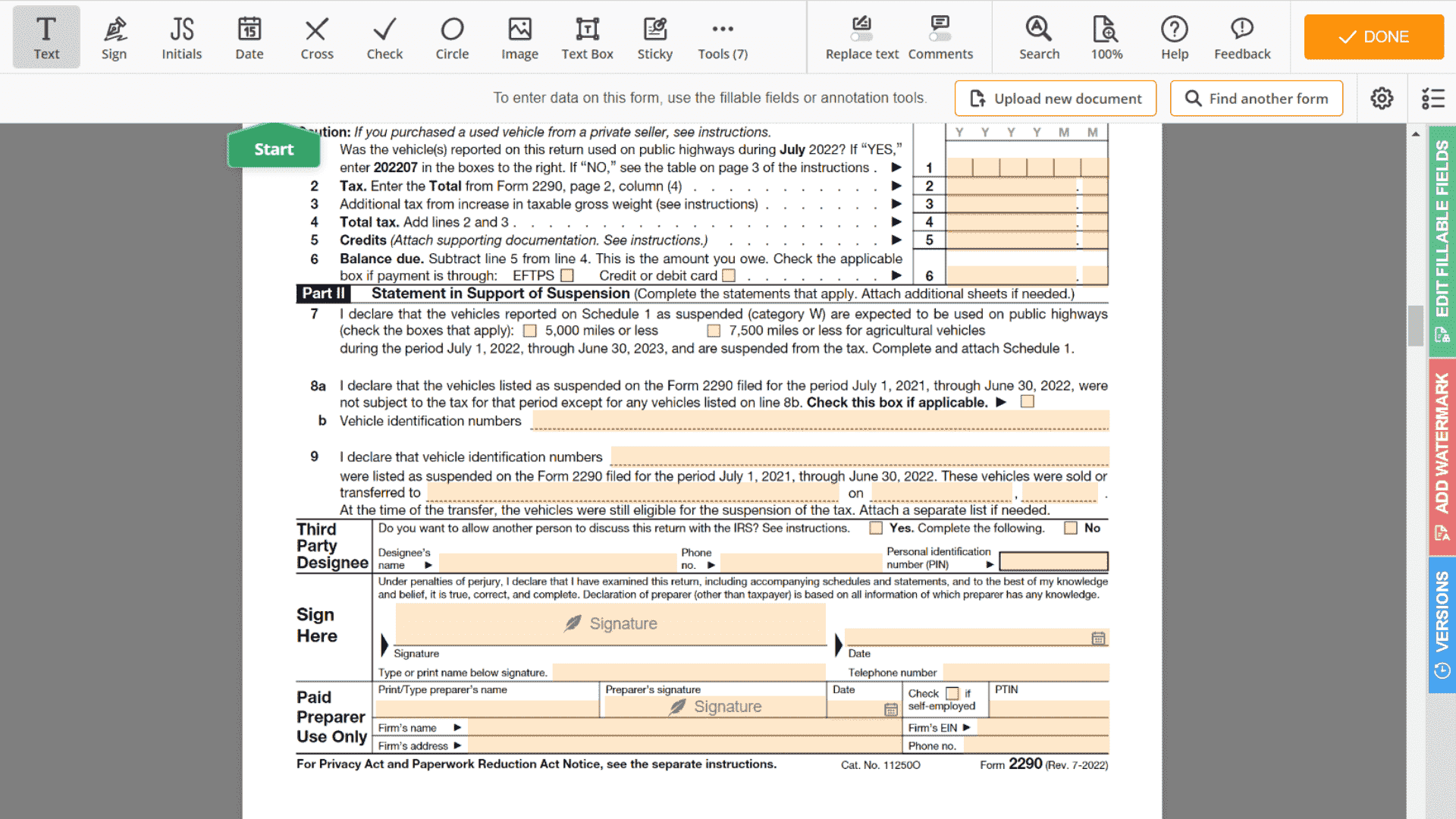

The printable 2290 form for 2022 is an essential document to file with the Internal Revenue Service (IRS) for individuals and organizations operating heavy highway vehicles. By utilizing our materials, users can easily download the template, fill it out online, and promptly submit their Form 2290 to the IRS. It is crucial to be aware of the exemptions associated with filing this sample, which we have outlined in the following bullet points:

- Vehicles driven less than 5,000 miles (7,500 miles for agricultural vehicles) within the tax year are exempt from the 2290 form requirements.

- Commercial vehicles with a gross weight of 55,000 pounds or less are not required to file Form 2290.

- Government-owned vehicles, such as those operated by federal, state, or local authorities, are exempt from filing.

- Emergency vehicles, including ambulances and fire trucks, do not need to submit the 2290 copy.

To better understand the filing process and requirements, we recommend reviewing a 2290 form example available on our site. This will help ensure that you complete the sample correctly and avoid any potential issues with your submission.

Fill Out Tax Form 2290 Quickly & Accurately

- Begin by downloading the 2290 form to print out from our website, ensuring you have the most up-to-date version.

- Open the 2023 Form 2290 PDF and carefully read the instructions provided.

- Start filling out the sample by entering your personal and business information, such as your name, address, and Employer Identification Number (EIN).

- Next, calculate the tax due based on the weight category of your vehicle, as described in the instructions for IRS Form 2290 printable for 2023.

- Accurately report any additional tax-related details, such as suspended vehicles, credits, or amendments.

- Double-check your entries to avoid errors.

- Lastly, sign and date the completed template.

If you need assistance, consult our instructions for further guidance. Once you've finished, submit your printable 2290 form to the IRS and keep a copy for your records.

Federal Form 2290 Instructions: Get Answers & Advice

- Where can I find a free printable 2290 form for 2023 on your website?

You can easily locate the relevant blank template on our platform by navigating to the menu or on top of the first screen. Once there, click on the "Get Form" link to access the printable version. You can then download it, print it, and fill it out as needed. - What is the purpose of the printable IRS tax form 2290, and who should file it?

Truck owners and operators use it to report and pay the Heavy Highway Vehicle Use Tax (HVUT) for vehicles with a taxable gross weight of 55,000 pounds or more. This tax is required for trucks that operate on public highways, and the collected funds are used for highway maintenance and construction. If you own or operate such a vehicle, you should file a printable 2290 tax form. - Can you provide any tax form 2290 instructions to help me complete the copy?

Absolutely! We offer a comprehensive guide to help you accurately complete the worksheet. You can find this guide in the "Updates" section, where you'll find step-by-step instructions, examples, and tips to ensure a smooth filing process. - How can I file the 2290 form online using your website?

Head to the top of the main page and click the “Get Form” button. There, you'll be guided through the process of creating an account, entering your vehicle and taxpayer information, and submitting your PDF electronically. The platform will calculate your tax liability and provide you with a digital copy of your stamped Schedule 1 once the IRS accepts your submission. - What should I do if I encounter any issues while using the IRS 2290 tax form printable on your website?

If you face any difficulties while downloading the PDF or using any other feature on our website, please don't hesitate to contact our support team. You can reach us through the "Contact Us" page.

Printable Form 2290 Instructions

Printable Form 2290 Instructions

File IRS Form 2290

File IRS Form 2290

2022 IRS Form 2290

2022 IRS Form 2290

IRS Form 2290 Printable for 2022-2023

IRS Form 2290 Printable for 2022-2023

How to File IRS Form 2290 Online (Fillable PDF)

How to File IRS Form 2290 Online (Fillable PDF)